You’ve just launched your inspection business, snagged a few jobs, and you’re finally feeling like things are starting to click.

Then a client calls. You missed a major plumbing issue, and they’re threatening legal action.

That’s where Errors & Omissions (E&O) and General Liability (GL) insurance come in. Think of them as your financial safety net when things don’t go according to plan.

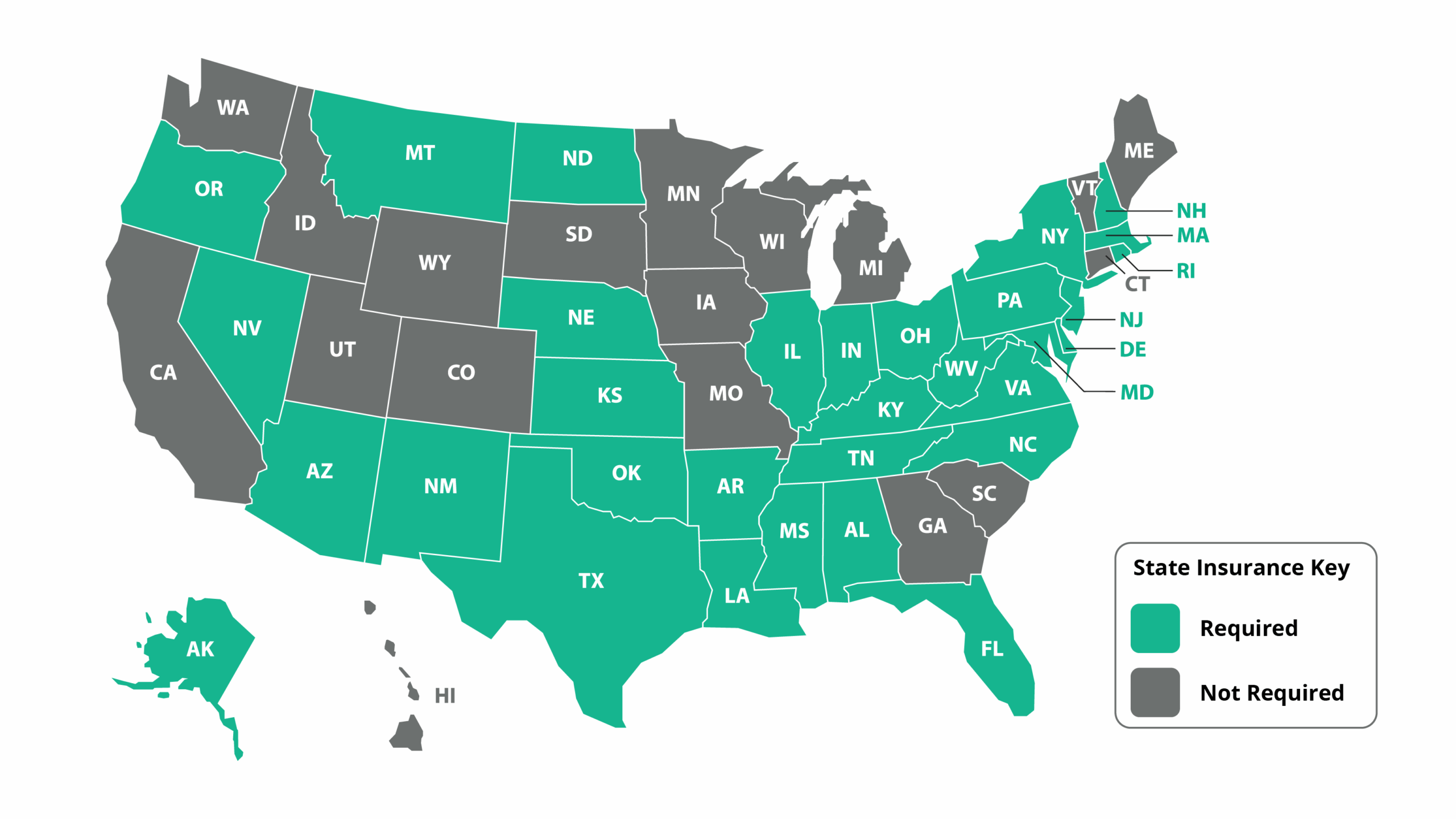

And here’s the kicker: Over 30 states require some form of insurance to operate as a licensed home inspector.

Let’s break down what you need to know.

What is business insurance

Business insurance (also known as commercial insurance) protects your business from financial loss caused by unexpected events, accidents, or liability claims.

For home inspectors, the two most important coverages are Errors & Omissions (E&O) and General Liability (GL). These policies work together.

Errors & Omissions (E&O) Insurance

This covers professional mistakes, like missed defects or inaccurate reporting.

Example: You didn’t catch hail damage on the roof. Months later, the buyer finds a leak and hold your responsible. E&O helps cover legal fees and any potential settlement.

General Liability (GL) Insurance

This covers third-party bodily injury or property damage that happens during an inspection.

Example: A client trips over your ladder and breaks their wrist. GL covers medical expenses and legal costs.

Why going without insurance is risky business

Even if you’re a one-person shop doing a few inspections a week, the risks are real. Legal costs add up fast, even if a claim is baseless. One lawsuit could potentially wipe out your business before it even gets off the ground.

In many cases, agents may pass you up if you don’t carry coverage – it’s often a dealbreaker. Business insurance doesn’t just protect you – it helps you stay competitive and credible in the market.

Smart insurance choices for growing your inspection business

Whether you’re brand new or starting to scale, your insurance coverage should match your current stage of business. Here’s how to think about it:

Just starting out? Here’s what to look for:

Not all policies are built for solo or new inspectors, so here’s what to prioritize when you’re just getting going:

- Affordable premiums – Pay for what you need now, not what you might need in five years

- Low deductibles – Look for deductibles you can actually pay, especially if you’re still ramping up business

- Inspector-specific coverage – Some insurers understand your risks better than general small-business providers

- Streamlined applications – You’ve got inspections to run, not paperwork to chase

- Customer service – If you’ve got questions, you need them answered

Growing fast? Make sure your policy keeps up

As your inspection business grows, so does your risk. Scaling up is a great sign, but it also comes with more complexity and liability.

- More clients mean more inspections, and more potential for disputes or legal complaints if something gets missed

- More employees or subs increases your responsibility – whether it’s a W2 or a 1099, you’re on the hook for their actions in the field

- Higher visibility means your reputation carries more weight – one unhappy client or legal issue could impact future referrals or partnerships

As you grow, your insurance coverage needs to grow with you. That means:

- Adjusting your coverage levels as inspection volume increases – a $100K policy might be enough when you’re starting out, but you’ll need more protection as your workload expands

- Ensuring your policy covers your whole team, including any 1099 contractors, because not all policies do this automatically

- Working with industry-specific carriers who understand inspection workflows, common claims, and your unique liability landscape

- Taking advantage of proactive risk management tools offered by providers like InspectorPro, including education, training, and claims prevention strategies

How to get coverage without the headache

A good insurance partner can make a real difference. Palmtech works with InspectorPro, a provider that focuses specifically on inspection businesses, so you’re not wading through generic coverage that doesn’t match your day-to-day risks.

Their application process is straightforward, coverage scales as you grow, and the support team actually understands what you do for a living.

Insurance might not be the flashiest part of your business, but it’s one of the most important. If you want to protect your business the smart way, get covered with Palmtech Business Insurance with InspectorPro. You’re already wearing all the hats – owner, marketer, inspector. Don’t add “legal defense team” to the mix.