The latest housing numbers show a small drop in sales but a steadier stream of contracts and inventory. For solo and small-shop inspectors, that points to consistent opportunities, even if buyers and sellers are moving cautiously.

Sales and inventory

- Existing home sales totaled 376,000 in August, down –3.3% from July and –0.8% YoY

- Year-to-date sales are down –1.2% (with July revised by +1,000)

- Inventory held at 1.53 million homes, flat month-over-month but up +9.5% YoY

- Months’ supply stayed at 4.6, signaling balanced but cooling conditions.

Contracts and pricing

- HouseCanary reports 296,630 homes went under contract, up +10.7% YoY

- Price cuts surged +22% YoY, the largest increase since 2020

- The national median existing home price hit $422,600, a +2.0% YoY gain

- Regional performance was mixed: Midwest (+4.5%) and Northeast (+6.2%) led, while the West was nearly flat (+0.6%)

- Median closed price rose +3.0% YoY to $442,427

Mortgage rates

- Mortgage rates averaged 6.8% in Q3

- Rates dipped to 6.17% in September, then climbed to 6.34% following the Fed’s rate cut

- Forecasts call for rates to gradually ease toward 6.5-6.4% by early 2026

Current forecasts

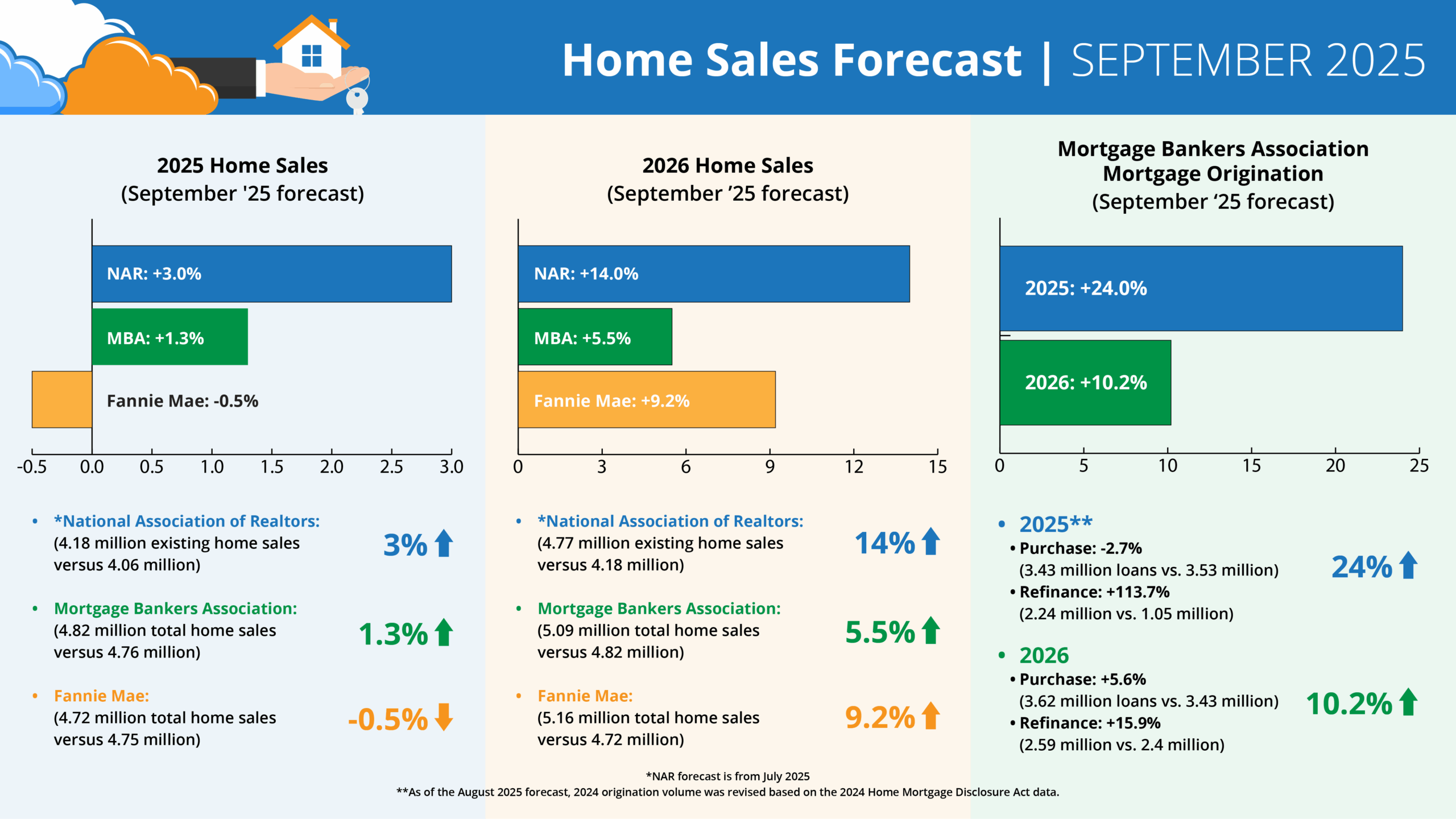

Forecasts for 2025 Home Sales (September’25 forecast)

- *NAR: +3.0% (4.18 million existing home sales vs. 4.06 million)

- MBA: +1.3% (4.82 million total home sales vs. 4.76 million)

- Fannie: -0.5% (4.72 million total home sales vs. 4.75 million)

Forecasts for 2026 Home Sales (September’25 forecast)

- *NAR: +14.0% (4.77 million existing home sales vs. 4.18 million)

- MBA: +5.5% (5.09 million total home sales vs. 4.82 million)

- Fannie: +9.2% (5.16 million total home sales vs. 4.72 million)

MBA Forecast for Mortgage Originations (September’25 forecast)

- 2025** Total Mortgage Originations: +24.0% (5.67 million loans vs. 4.57 million)

- Purchase: -2.7% (3.43 million loans vs. 3.53 million)

- Refi: +113.7% (2.24 million vs. 1.05 million)

- 2026 Total Mortgage Originations: +10.2% (6.24 million loans vs. 5.67 million)

- Purchase: +5.6% (3.62 million loans vs. 3.43 million)

- Refi: +15.9% (2.59 million vs. 2.4 million)

* NAR forecast is from July 2025

What it means for inspectors

For Palmtech users running lean operations, the mix of fewer closed sales but rising contracts means inspection work should hold steady. Sellers cutting prices at the fastest pace since 2020 often means deals move faster once an offer is made. That creates chances for inspectors who can respond quickly and flexibly.

The 2026 outlook is more encouraging, with all three major forecasters projecting growth. That makes now a smart time to focus on efficiency – whether it’s streamlining your reports or tightening up scheduling – so you’re ready to take on more inspections when volumes climb.