September’s housing numbers tell a mixed story – fewer closed sales, more listings, and steady contract activity. For solo and small-shop inspectors, that translates to a balanced pipeline, especially as sellers keep cutting prices to stay competitive.

Sales and inventory

- Existing home sales totaled 357,000 in September, down –5.1% from August but +8.2% YoY

- Year-to-date sales are now down –0.2%

- Active listings reached 1.56 million homes (+21.9% YoY), marking the largest supply since 2020, according to HouseCanary

- Month’s supply climbed to 5.49, edging toward a buyer’s market

Contracts and pricing

- HouseCanary reports 283,409 homes went under contract, up +11.0% YoY

- Price cuts rose +21.6% YoY, remaining at their highest level since 2020

- The median closed price increased +3.5% YoY to $433,239

- The national median existing home price was $415,200, a +2.1% YoY gain

- Regionally, the Midwest (+4.7%) and Northeast (+4.1%) led, while the West (+0.4%) remained flat

Mortgage rates

- Mortgage rates averaged 6.6% in Q3

- Fannie Mae now projects rates to decline more gradually to 6.2% by early 2026 and 5.9% by the end of the year, while the Mortgage Bankers Association expects rates to stay near 6.5% through 2028

Current forecasts

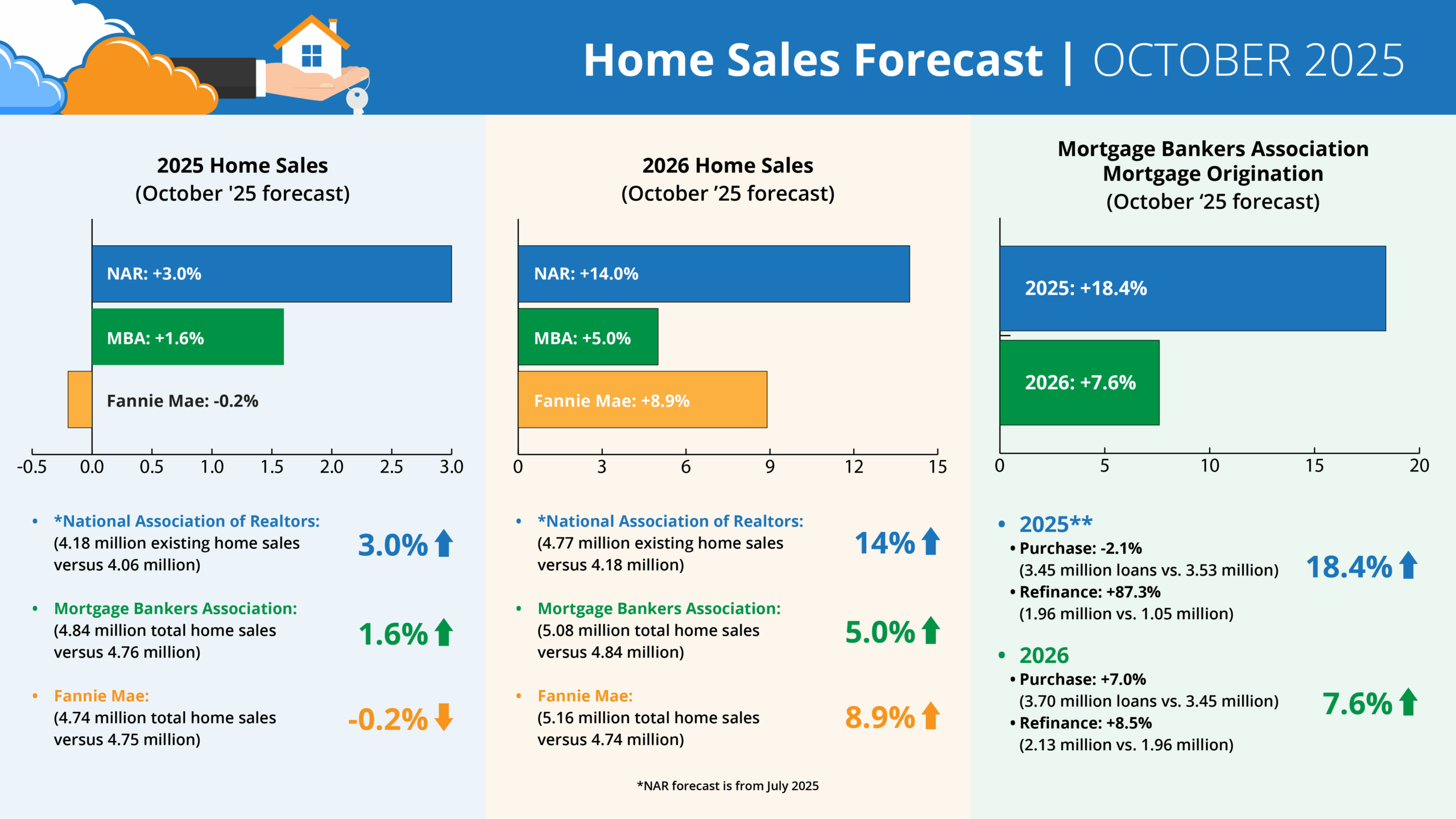

Forecasts for 2025 home sales (October ‘25 forecast)

- *NAR: +3.0% (4.18 million existing home sales vs. 4.06 million)

- MBA: +1.6% (4.84 million total home sales vs. 4.76 million)

- Fannie: -0.2% (4.74 million total home sales vs. 4.75 million)

Forecasts for 2026 Home Sales (October ’25 forecast)

- *NAR: +14.0% (4.77 million existing home sales vs. 4.18 million)

- MBA: +5.0% (5.08 million total home sales vs. 4.84 million)

- Fannie: +8.9% (5.16 million total home sales vs. 4.74 million)

MBA Forecast for Mortgage Originations (October ’25 forecast)

- 2025** Total Mortgage Originations: +18.4% (5.41 million loans vs. 4.57 million)

- Purchase: -2.1% (3.45 million loans vs. 3.53 million)

- Refi: +87.3% (1.96 million vs. 1.05 million)

- 2026 Total Mortgage Originations: +7.6% (5.82 million loans vs. 5.41 million)

- Purchase: +7.0% (3.70 million loans vs. 3.45 million)

- Refi: +8.5% (2.13 million vs. 1.96 million)

* NAR forecast is from July 2025

What it means for inspectors

For Palmtech users, higher inventory and faster-moving contracts keep inspections coming – even as sales slow. Price cuts could speed up decisions, and buyers have more homes to choose from. That’s good news for inspectors who can respond quickly and turn around polished reports fast.

With all major forecasters calling for 2026 growth, this is the time to streamline your process. Use Palmtech to simplify report writing, manage payments, and stay ready for a busier year ahead.