The housing market saw some fresh signs of life in May – and if you’re running inspections solo, it’s smart to track how this affects your schedule.

Buyers finally have a bit more to choose from, with inventory reaching levels we haven’t seen in a few years. Sales jumped compared to last month, though they’re still slower than this time last year. Meanwhile, sellers are slashing prices more often to attract buyers dealing with high rates and tight budgets.

Speaking of rates – there may be little relief on the horizon. Some experts think we’ll see a drop closer to the end of 2025, opening the door for more deals (and more inspections) heading into fall.

May sales inventory at a glance

- About 389,000 existing homes sold in May 2025, a jump of +11.5% from April but still -4.0% lower than May 2024

- Year-to-date sales are running -2.8% below last year

- Inventory rose to 1.54 million homes, up +6.2% month-over-month—the highest supply we’ve seen since 2020

- 6 months of supply puts the market in more balanced territory, but it’s still competitive

- HouseCanary reports a +22.9% increase in inventory YoY and a +5.8% bump in contract volume

- Closed prices were up +1.9%, but sellers made +34.7% more price cuts to close deals in this market

Home prices and regional hotspots

- National median home price: $422,800, a +1.3% rise over last year

- Biggest price jumps: Midwest (+3.4%) and Northeast (+7.1%)

What’s happening with mortgage rates?

- Average mortgage rates in June: 6.8%, holding steady but still high

- Forecasts point to rates dropping toward 6.5% by year-end, helping buyers stretch their budgets a little further

Housing and mortgage forecast

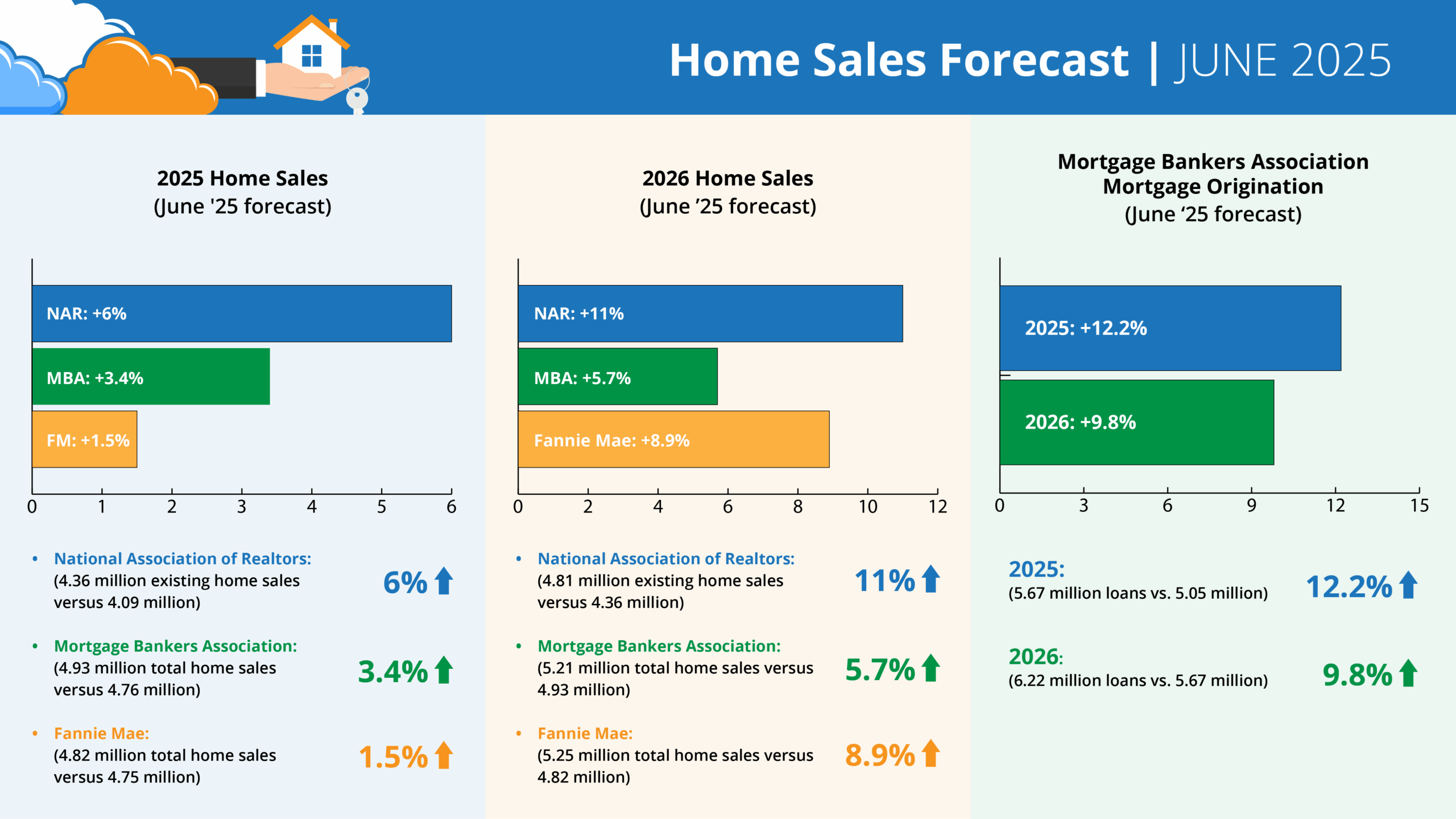

2025 home sales forecasts (June 2025)

- NAR: +6% growth to 4.36 million existing home sales (up from 4.09 million in 2024)

- MBA: +3.4% growth to 4.93 million total home sales (up from 4.76 million)

- Fannie Mae: +1.5% growth to 4.82 million total home sales (up from 4.75 million)

2026 home sales forecasts (June 2025):

- NAR: +11% growth to 4.81 million existing home sales (up from 4.36 million)

- MBA: +5.7% growth to 5.21 million total home sales (up from 4.93 million)

- Fannie Mae: +8.9% growth to 5.25 million total home sales (up from 4.82 million)

MBA mortgage originations forecast (June 2025):

2025 total mortgage originations: +12.2% growth to 5.67 million loans (up from 5.05 million)

- Purchase: +2.4% growth to 3.44 million loans (up from 3.36 million)

- Refinance: +31.8% growth to 2.23 million loans (up from 1.69 million)

2026 total mortgage originations: +9.8% growth to 6.22 million loans (up from 5.67 million)

- Purchase: +5.9% growth to 3.64 million loans (up from 3.44 million)

- Refinance: +15.8% growth to 2.58 million loans (up from 2.23 million)

What this means for new and small inspection shops

More listings mean more opportunities to fill your calendar—but rates and prices still make this a cautious market. If rates drop later this year, you’ll want to be ready with an easy online booking process, polished reports, and fast turnaround times that win over agents and buyers.