The housing market didn’t move much in June, but that’s not necessarily a bad thing. Home sales ticked up slightly, inventory stayed strong, and price growth held steady – especially in the Midwest and Northeast.

Forecasts for 2025 have come down a bit, but 2026 is shaping up to be a stronger year. If mortgage rates drop as expected, activity could ramp up this fall – and inspectors who stay ready to book, inspect, and get paid quickly will be in a great spot.

Here’s a look at what’s happening:

June 2025 numbers at a glance

- Existing home sales totaled 391,000 (non-seasonally adjusted), up just +0.3% from May and +4.0% year-over-year; year-to-date, sales are down -1.5%

- Inventory held at 1.53 million homes – just under the May high, and up +15.9% YoY

- HouseCanary reports a +23.1% increase in inventory and +7.3% increase in contract volume; closed prices rose +2.8%, while price cuts jumped +32.3%

- The national median existing home price hit $435,300, a +2.0% YoY increase; the Midwest (+3.4%) and Northeast (+4.2%) led in price gains

- Mortgage rates averaged 6.8% in June; the Mortgage Bankers Association (MBA) expects a slight drop to 6.7% by the end of 2025

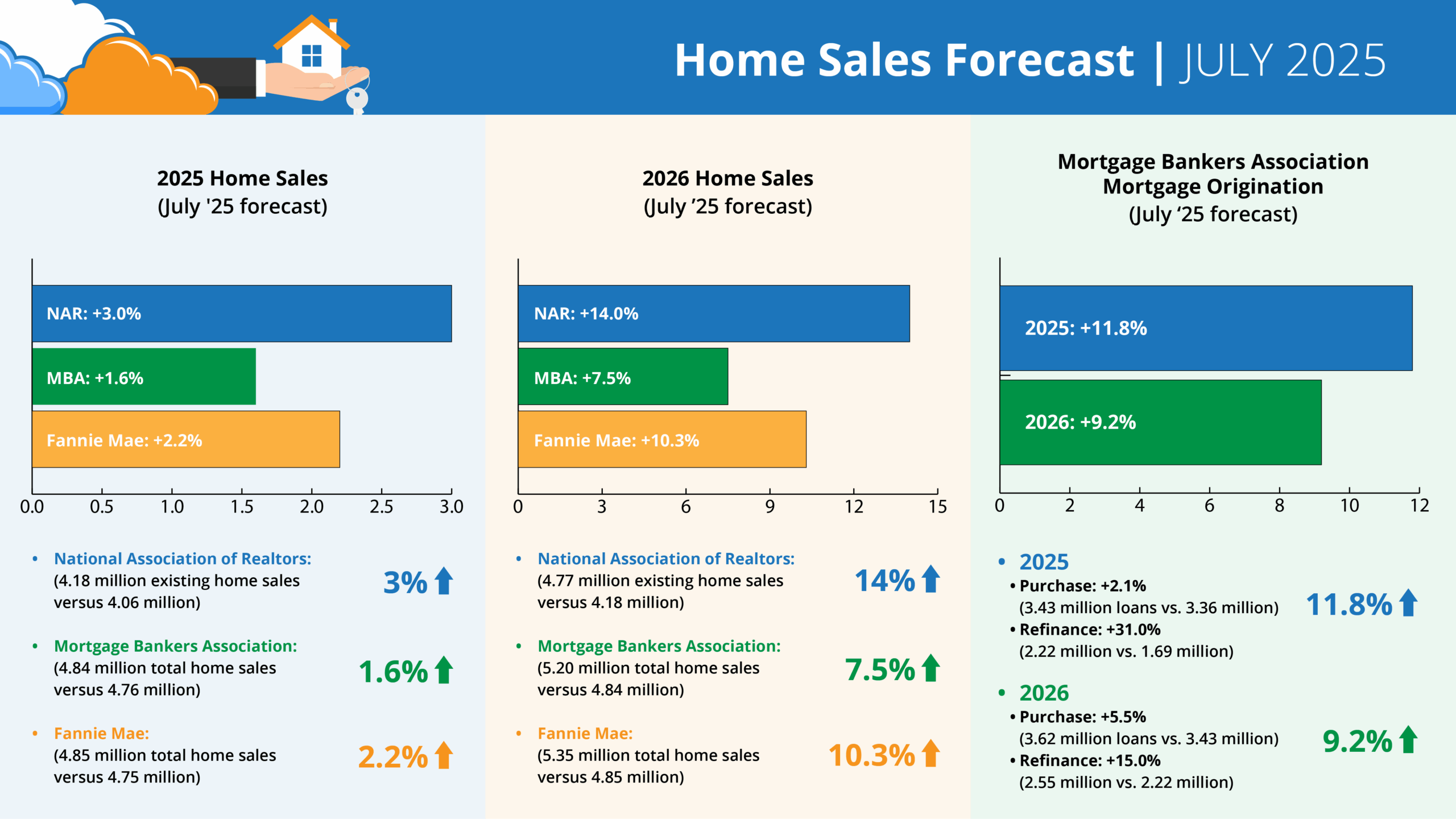

Updated forecasts from NAR, MBA, and Fannie Mae

NAR Q2 update:

- 2025 existing home sales forecast lowered to 3% YoY growth (previously +6%)

- 2026 forecast raised to +14% YoY growth (previously +11%)

- Combined 2025 forecast average (NAR, MBA, Fannie): +2.3% YoY growth, down from +6.8% at the start of the year

Forecasts for 2025 home sales (July ’25 forecast)

- NAR: +3.0% (4.18 million existing home sales vs. 4.06 million)

- MBA: +1.6% (4.84 million total home sales vs. 4.76 million)

- Fannie Mae: +2.2% (4.85 million total home sales vs. 4.75 million)

Forecasts for 2026 home sales (July ’25 forecast)

- NAR: +14.0% (4.77 million existing home sales vs. 4.18 million)

- MBA: +7.5% (5.20 million total home sales vs. 4.84 million)

- Fannie Mae: +10.3% (5.35 million total home sales vs. 4.85 million)

MBA forecast for mortgage originations (July ’25 forecast)

2025 total mortgage originations: +11.8% (5.65 million loans vs. 5.05 million)

- Purchase: +2.1% (3.43 million loans vs. 3.36 million)

- Refinance: +31.0% (2.22 million vs. 1.69 million)

2026 total mortgage originations: +9.2% (6.17 million loans vs. 5.65 million)

- Purchase: +5.5% (3.62 million loans vs. 3.43 million)

- Refinance: +15.0% (2.55 million vs. 2.22 million)

What this means for inspectors

Steady numbers and a clear path forward – that’s what June’s housing data points to. For inspectors running solo or with a small team, this is the time to stay lean, efficient, and ready to move when clients are.

Palmtech helps you move fast, from writing reports to getting paid – without cutting corners. If buyer activity picks up this fall, make sure you’ve got the right tools to keep up.