Slower closings, but buyers are still out there

November slowed down on the closing side as is typical for the winter months. According to the National Association of Realtors (NAR), existing home sales totaled 293,000 (non-seasonally adjusted), down -18.4% from October and -7.0% year over year. Year-to-date sales are now down -0.5% compared to 2024.

Even so, buyers haven’t disappeared. Data from HouseCanary shows new listings dropped -16.2% YoY, but 248,109 homes still went under contract, up +10.1% YoY. That means fewer chances, but real movement when the right home shows up.

Prices haven’t slipped much

Prices remain fairly steady. HouseCanary indicates median listing prices are down just -0.3% YoY, while median closed prices rose +3.4%.

And according to the Mortgage Bankers Association (MBA), the national median home price reached $409,200, up +1.2% YoY. The Midwest saw the strongest growth at +5.8%, while other regions stayed mostly flat.

Mortgage rates and what inspectors should expect

The MBA indicates mortgage rates averaged 6.6% in Q3 2025, with forecasts from Fannie Mae pointing to a gradual dip into 2026. Refinance activity is expected to stay active, while purchase volume continues to depend on inventory.

Current forecasts

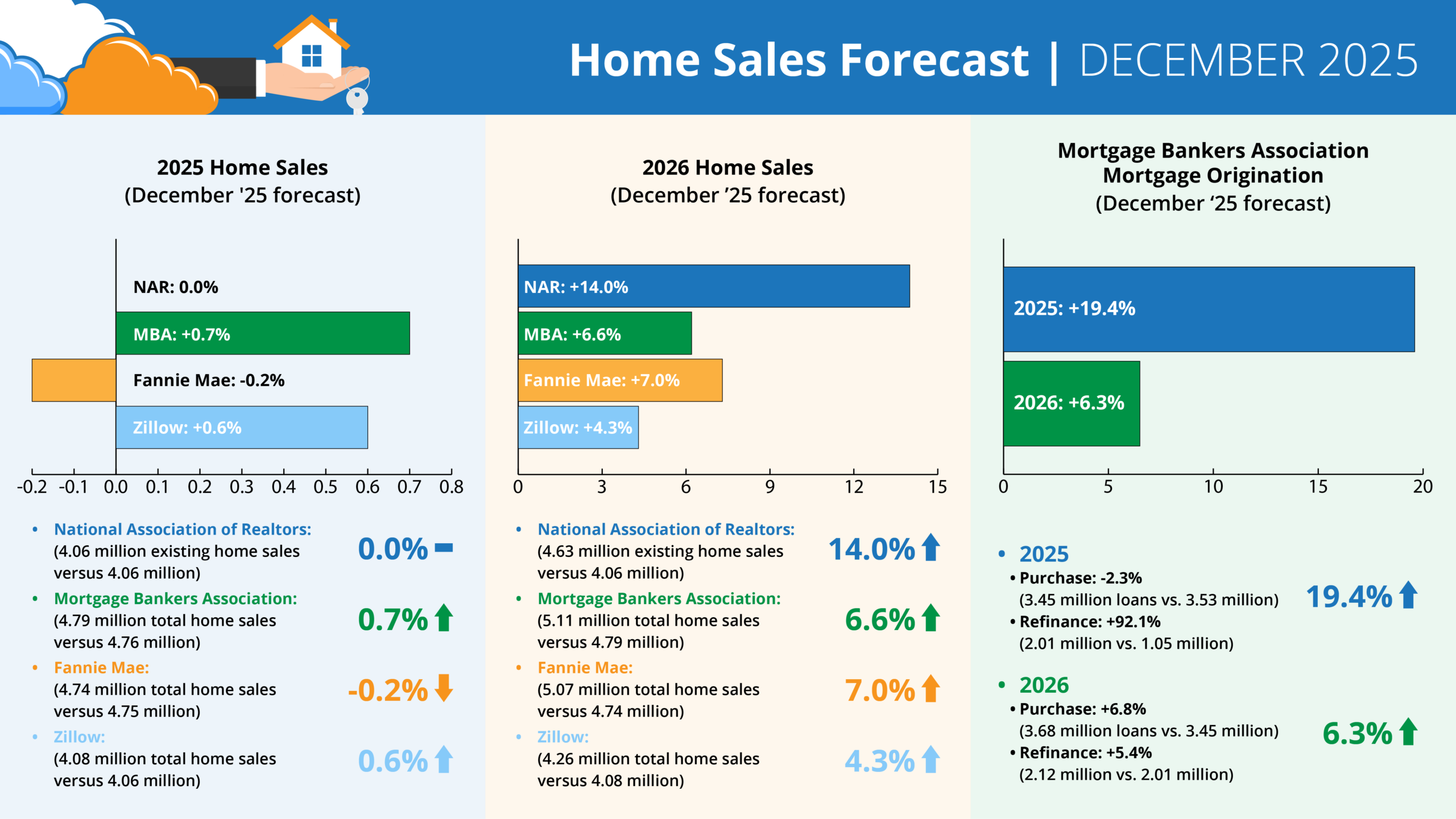

Forecasts for 2025 home sales (December ‘25 forecast)

- NAR: 0.0% (4.06 million existing home sales vs. 4.06 million)

- MBA: +0.7% (4.79 million total home sales vs. 4.76 million)

- Fannie Mae: -0.2% (4.74 million total home sales vs. 4.75 million)

- Zillow: +0.6% (4.08 million existing home sales vs. 4.06 million)

Forecasts for 2026 home sales (December ‘25 forecast)

- NAR: +14.0% (4.63 million existing home sales vs. 4.06 million)

- MBA: +6.6% (5.11 million total home sales vs. 4.79 million)

- Fannie Mae: +7.0% (5.07 million total home sales vs. 4.74 million)

- Zillow: +4.3% (4.26 million existing home sales vs. 4.08 million)

MBA forecast for mortgage originations (December ‘25 forecast)

2025 total mortgage originations: +19.4% (5.46 million loans vs. 4.57 million)

- Purchase: -2.3% (3.45 million loans vs. 3.53 million)

- Refi: +92.1% (2.01 million vs. 1.05 million)

2026 total mortgage originations: +6.3% (5.80 million loans vs. 5.46 million)

- Purchase: +6.8% (3.68 million loans vs. 3.45 million)

- Refi: +5.4% (2.12 million vs. 2.01 million)

What it means for solo and small inspection shops

For newer inspectors and small shops, November shows why flexibility matters. Fewer listings can mean uneven weeks, but inspections are still happening when buyers move quickly.

With sales growth projected for 2026, staying organized and efficient now helps you be ready when volume increases.