Palmtech is keeping an eye on the numbers so you don’t have to. We’re bringing you key data from the housing market that could affect your inspection schedule – and your bottom line.

A look back at March 2025

- 315,000 existing homes were sold (non-seasonally adjusted), up 22.6% MoM, but down 3.1 YoY

- Inventory climbed 19.8% YoY, pushing supply up to 4.0 months – a sign of a shifting market

- Contract volumes rose 4.5% YoY, but price cuts surged 40.8%, suggesting buyers are still feeling the pinch

- The median closed price rose 4.8% YoY to $431,019

- Mortgage rates hovered between 6.5% and 7.0%, continuing to slow purchases in the lower price tiers

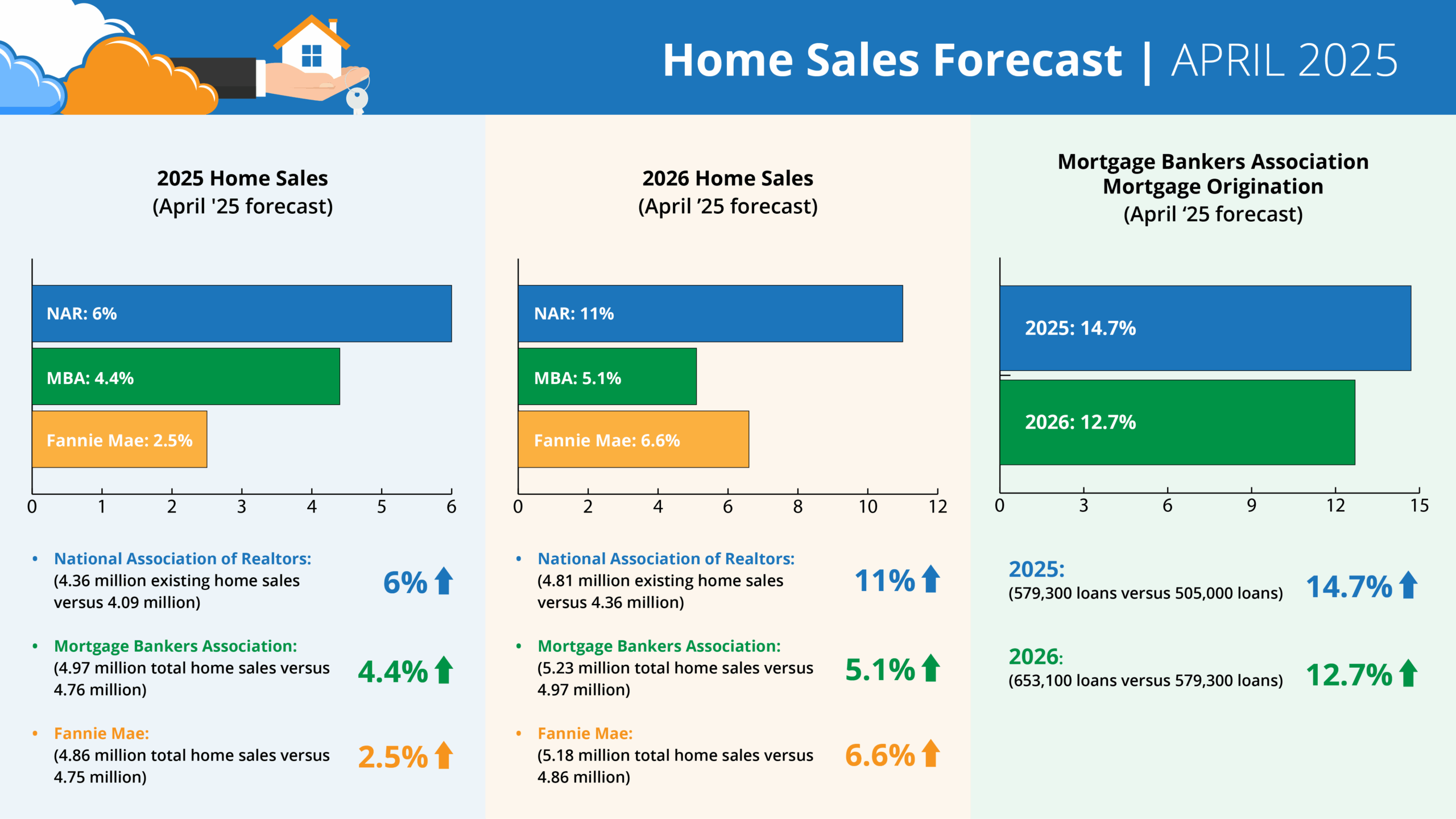

What the April 2025 forecasts said:

For 2025 home sales:

- NAR: 6% increase (4.36M vs. 4.09M)

- MBA: 4.4% increase (4.97M vs. 4.76M)

- Fannie Mae: 2.5% increase (4.86M vs. 4.75M)

For 2026 home sales:

- NAR: 11.0% increase (4.81M vs. 4.36M)

- MBA: 5.1% increase (5.23M vs. 4.97M)

- Fannie Mae: 6.6% increase (5.18M vs. 4.86M)

Mortgage Bankers Association originations:

- 2025: 14.7% increase (579,300 vs. 505,000)

- 2026: 12.7% increase (653,100 vs. 579,300)

Forecast data sourced from the National Association of Realtors, Mortgage Bankers Association, Fannie Mae and HouseCanary.

Stay tuned to Palmtech each month for insights that help you stay informed, flexible, and profitable.